GET YOUR FREE HOME EVALUATION

By checking this box, I agree by electronic signature to the Electronic Disclosure Consent Agreement; to receive recurring marketing communication from or on behalf of Jack Bouvier, including auto-dialed calls, texts, and artificial/prerecorded voice messages (message frequency varies; data rates may apply; reply "STOP" to opt-out of texts or "HELP" for assistance); and to the Terms of Service and Privacy Policy of this website. Consent not required to make a purchase. I understand that I can call to obtain direct assistance.

Why Choose Us

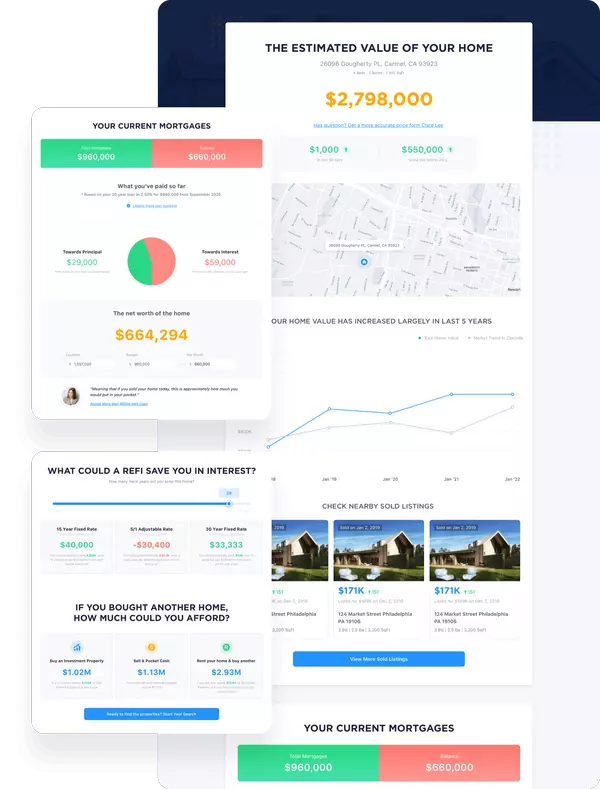

1. More Than Just an Online Estimate

Online tools rely on generic formulas that don’t factor in upgrades, renovations, or neighborhood trends. Our valuation is backed by real sales data and local expertise to provide an accurate value.

2. Know Your Equity & Borrowing Power

If you’re thinking of refinancing, lenders look at your home’s value to determine loan amounts and interest rates. An accurate valuation helps you secure better mortgage terms & use your equity wisely

3. Sell for the Right Price & Maximize Profit

Pricing too high can scare away buyers, while underpricing means losing money. We help you set the right price so your home sells faster and for top dollar.

4. Plan Your Next Move with Confidence

Your home’s value affects how much you can afford on your next purchase. Whether upgrading or downsizing, knowing your home’s worth helps you plan your budget.

5. Local Experts. Real Data. No Guesswork.

We track real-time sales and market trends so you get a valuation you can trust. No automated estimates—just expert insight.